1. Carbon (formerly Paylater)

Carbon is one of Nigeria’s most popular and trusted lending apps, known for transparency and a smooth borrowing experience.

Quick and easy loan application, flexible repayment options, and no hidden charges. It also offers credit score tracking and investment options.

Interest Rate: Low interest rates; offers zero-interest loans for new users under certain conditions.

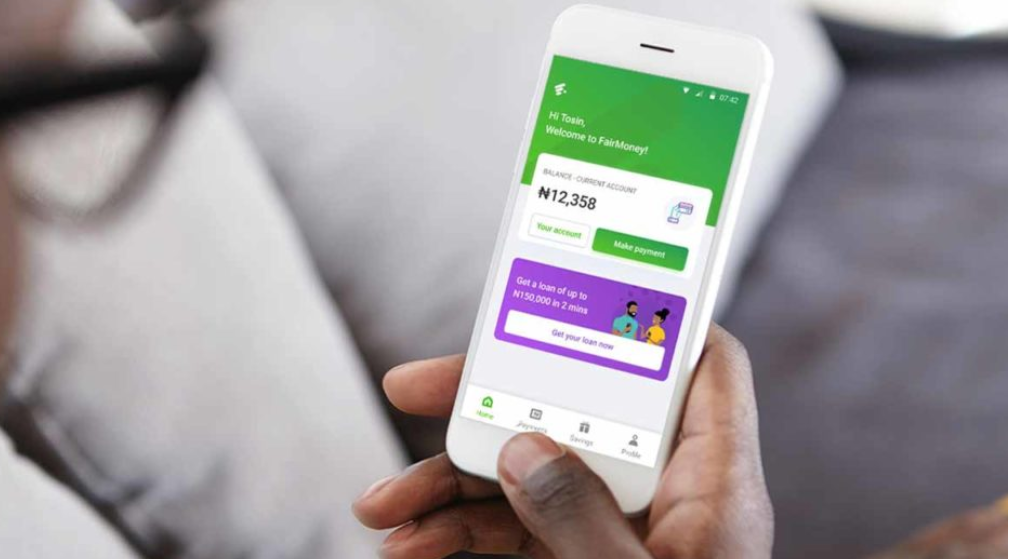

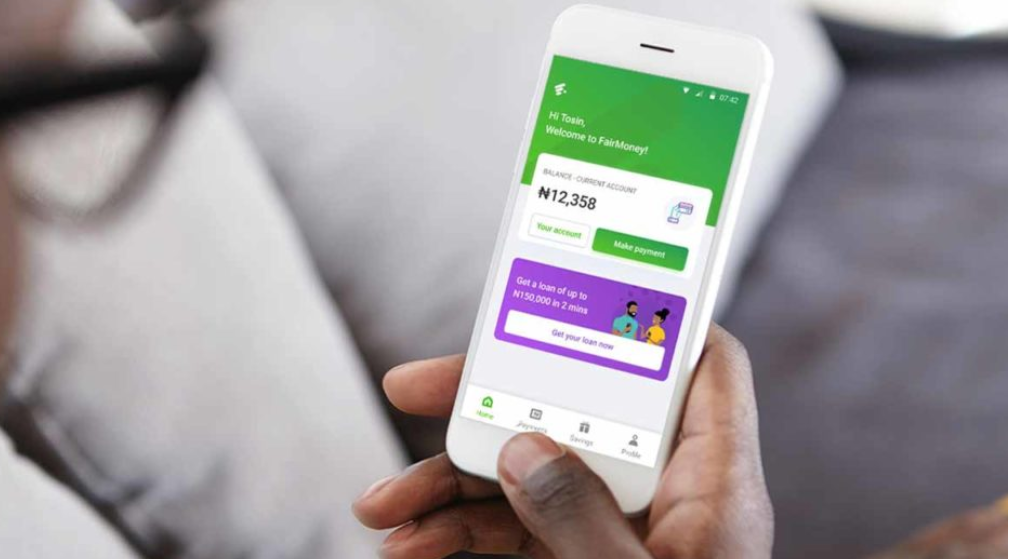

2. FairMoney

FairMoney is known for its fast loan disbursements and clear terms, ensuring no hidden fees or surprise charges.

Provides personal loans, bill payments, and savings options. Loans are available quickly, and the app is easy to navigate.

Interest Rate: Competitive interest rates starting from around 2.5% per month.

3. Branch

It’s a well-established app with a large user base, offering loans based on creditworthiness, and ensures data privacy.

Branch offers flexible loan terms with no collateral required. It also provides quick loan approvals and disbursements directly to your bank account.

Interest Rate: Interest rates start from as low as 15% per annum.

4. QuickCheck

The app has a strong reputation for transparency and fast processing, with minimal paperwork required.

QuickCheck offers short-term loans without collateral, and approvals happen within minutes. The app also tracks your credit score to offer customized loan options.

Interest Rate: Low interest rates, with loans starting from 5% per month.

5. Aella Credit

Aella Credit is popular for offering loans to individuals and businesses, with a focus on financial inclusion for underserved Nigerians.

Offers personal and business loans, as well as credit score management. It provides loans without the need for collateral, and funds are disbursed quickly

Interest Rate: Flexible rates with no interest on the first loan in some cases..

These apps provide a range of loan options, including both short-term and long-term plans, with competitive interest rates or zero-interest offers for first-time borrowers. Always review the terms and conditions before borrowing to ensure you understand the repayment schedule and any applicable fees.