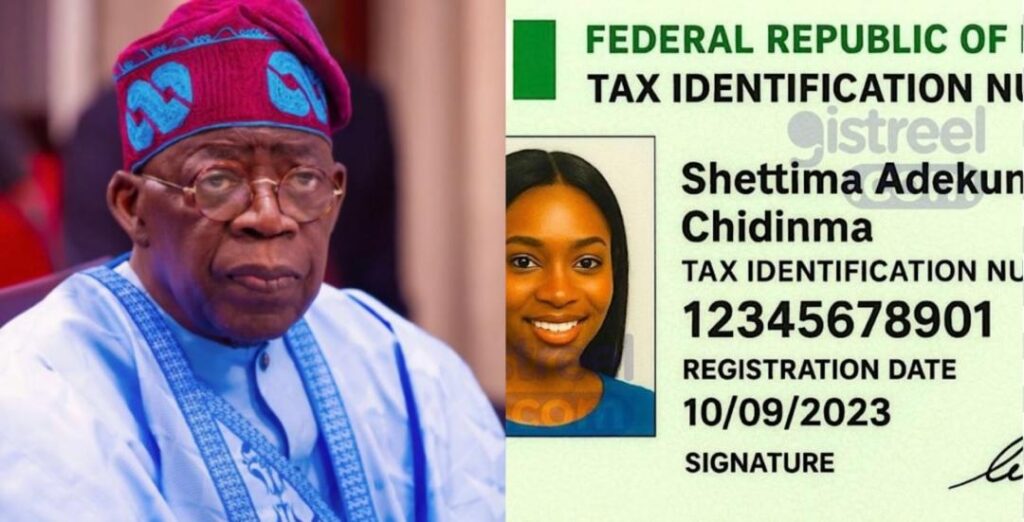

FG Announces Mandatory Tax ID for All Bank Accounts Starting January 2026

The Federal Government (FG) of Nigeria has announced a new policy that will take effect from January 2026: all bank accounts must be linked to a Tax Identification Number (TIN). This move is aimed at improving tax compliance and ensuring a more transparent financial system across the country.

According to the policy, anyone attempting to open a bank account without a valid Tax ID will not be permitted to do so. Existing account holders who do not have a TIN may also be required to update their records to comply with the new regulation.

Officials have emphasized that the policy is part of broader reforms to strengthen Nigeria’s tax system, reduce fraud, and improve revenue collection. Banks across the country will be expected to enforce the rule, and customers are encouraged to obtain their TIN well in advance to avoid any disruptions to their banking activities.

The announcement has generated widespread discussion online, with many Nigerians expressing both support and concern over the new requirement. Supporters argue that it will make financial transactions more secure and reduce illicit activities, while critics worry about potential challenges for those who do not have a TIN or have limited access to tax registration facilities.

Experts recommend that individuals start the process of obtaining a Tax Identification Number as soon as possible. The Federal Inland Revenue Service (FIRS) has made the registration process accessible online and at local tax offices to ensure that Nigerians can comply without difficulty.

As the January 2026 deadline approaches, banks and financial institutions are expected to roll out detailed guidelines to help customers align with the new policy. This reform underscores the government’s commitment to financial transparency and tax compliance in Nigeria.